In Estate of Berger, a new California case, the California Court of Appeal, Second District (May 25, 2023, B321347) has held that an 18-year-old typed, signed letter, that is not witnessed or notarized, is decedent Melanie Berger’s valid will. The typed letter is dated August 16, 2002. Melanie died eighteen years later. Below I have pasted a screenshot of the introduction summary from the decision in Estate of Berger and a screenshot copy of the August 16, 2002, letter which is attached to the decision as an exhibit, and I have also attached below a pdf copy of the full decision in Estate of Berger.

The decision is twenty-three pages. Typically I only post about a case after I have done a fairly deep evaluation; however, and although I have not yet had the time to do a more full evaluation of Estate of Berger, I decided to make this preliminary post because I am intrigued with the facts, the introduction summary from the decision in Estate of Berger, the letter, and the overall decision. Meanwhile, you can also read the full decision yourself by clicking on the full copy pdf below.

In her August 2002, social security related letter Melanie named Maria as her sole beneficiary. And Melanie did not keep her wishes at that time, and/or the letter, secret. The decision states that Melanie and Maria ended their romantic relationship the next year in the Spring of 2003 and ceased all contact with one another. Melanie died 18 years later on November 30, 2020. It appears that Melanie never did a more recent will instrument, or at least a more recent will was not introduced as evidence – however, in 2020 Melanie had told neighbors that she wanted to leave her assets to the church with which she had become close but there was no evidence that Melanie memorialized this.

The underlying intent of the law in California is that the decedent’s assets should go to the people or beneficiaries as the decedent would have intended and wished, as allowed by the law. You might notice from a prior post or two that I do believe that in certain limited circumstances it should be possible to present a case and a claim to the court that a will or a trust is the decedent’s last will or trust although that will or trust does not meet formal instrument requirements, or in the alternative situation to present a case and a claim to the court that a supposed last will or trust that does meet formal instrument requirements should not be allowed or admitted as the decedent’s last will or trust.

Under the facts in Estate of Berger there is a question whether what Melanie stated in her 2002 letter represents what her wishes were or would have been 18 years later in 2020. The 2002 letter also does not satisfy the California Probate Code section 6110 requirement that there be two witnesses. And the letter also does not satisfy the Probate Code section 6111 requirements to be a holographic will. However, I have pasted California Probate Code section 6110 immediately below – see subsection (c)(2) which provides for an exception to the formal requirements at the time that the purported will is signed (and apparently irrespective of what the decedent wanted or would have wanted 18 years later):

(a) Except as provided in this part, a will shall be in writing and satisfy the requirements of this section.

(b) The will shall be signed by one of the following:

(1) By the testator.

(2) In the testator’s name by some other person in the testator’s presence and by the testator’s direction.

(3) By a conservator pursuant to a court order to make a will under Section 2580.

(c) (1) Except as provided in paragraph (2), the will shall be witnessed by being signed, during the testator’s lifetime, by at least two persons each of whom (A) being present at the same time, witnessed either the signing of the will or the testator’s acknowledgment of the signature or of the will and (B) understand that the instrument they sign is the testator’s will.

(2) If a will was not executed in compliance with paragraph (1), the will shall be treated as if it was executed in compliance with that paragraph if the proponent of the will establishes by clear and convincing evidence that, at the time the testator signed the will, the testator intended the will to constitute the testator’s will.

The full twenty-three page decision in Estate of Berger requires careful factual and legal evaluation. For now, however, I have provided the above comments, and the two screenshots and the full copy of the decision below.

The following is the introduction summary from the decision in Estate of Berger:

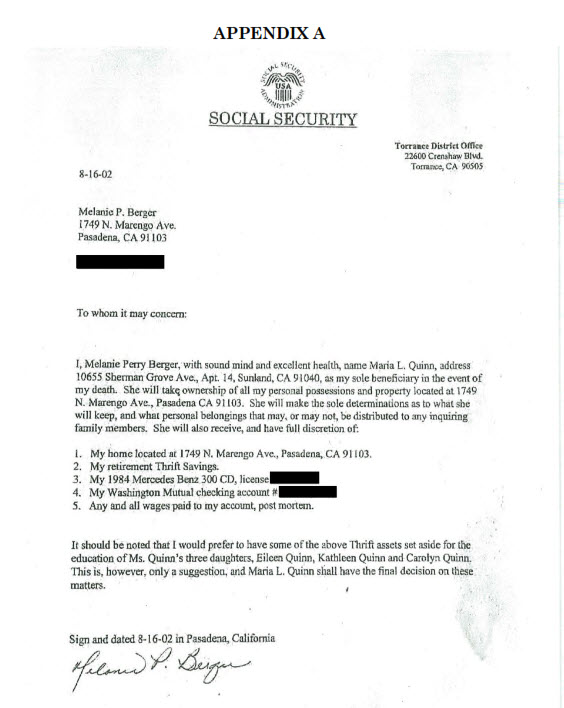

The following is a copy of Melanie’s 2002 letter which was attached as an exhibit in the decision in Estate of Berger:

And the following is a pdf copy of the full decision in Estate of Berger:

That’s all for now.

* * * * * * *

Thank you for viewing. Please do pass this blog and blog post and information to other people who would be interested as it is only through collaboration and sharing that great things and success are more quickly achieved.

David Tate, Esq. (and inactive CPA)

- Business litigation and disputes – business, breach of contract/commercial, co-owners, shareholders, investors, founders, workplace and employment, environmental, D&O, governance, boards and committees.

- Trust, estate and probate court litigation and disputes – trust, estate, probate, elder and dependent abuse, conservatorship, POA, real property, mental health and care, mental capacity, undue influence, conflicts of interest, and contentious administrations.

- Governance, boards, audit and governance committees, investigations, auditing, ESG, etc.

- Mediator and facilitating dispute resolution:

- Trust, estate, probate, conservatorship, elder and dependent abuse, etc.

- Business, breach of contract/commercial, owner, shareholder, investor, etc.

- D&O, board, audit and governance committee, accountant and CPA related.

- Other: workplace and employment, environmental, trade secret.

Remember, every case and situation is different. It is important to obtain and evaluate all of the evidence that is available, and to apply that evidence to the applicable standards and laws. You do need to consult with an attorney and other professionals about your particular situation. This post is not a solicitation for legal or other services inside of or outside of California, and, of course, this post only is a summary of information that changes from time to time, and does not apply to any particular situation or to your specific situation. So . . . you cannot rely on this post for your situation or as legal or other professional advice or representation, or as or for my opinions and views on the subject matter.

Also note – sometimes I include links to or comments about materials from other organizations or people – if I do so, it is because I believe that the materials are worthwhile reading or viewing; however, that doesn’t mean that I don’t or might not have a different view about some or even all of the subject matter or materials, or that I necessarily agree with, or agree with everything about or relating to, that organization or person, or those materials or the subject matter.

Please also subscribe to this blog and my other blog (see below), and connect with me on LinkedIn and Twitter.

My two blogs are:

http://tateattorney.com – business, D&O, audit committee, governance, compliance, etc. – previously at http://auditcommitteeupdate.com

Trust, estate, conservatorship, elder and elder abuse, etc. litigation and contentious administrations http://californiaestatetrust.com

David Tate, Esq. (and inactive California CPA) – practicing only as an attorney in California.