By way of background, in relevant part California Probate Code sections 21380(a)(3) and (4) provide as follows (a full copy of section 21380 is provided at the end of this post):

“21380. Presumption of fraud or undue influence for certain enumerated transfers; burden of proof; costs and attorney’s fees

(a) A provision of an instrument making a donative transfer [e.g., such as a will, trust, transfer on death deed, etc.] to any of the following persons is presumed to be the product of fraud or undue influence:

* * * * *

(3) A care custodian of a transferor who is a dependent adult, but only if the instrument was executed during the period in which the care custodian provided services to the transferor, or within 90 days before or after that period.

(4) A care custodian who commenced a marriage, cohabitation, or domestic partnership with a transferor who is a dependent adult while providing services to that dependent adult, or within 90 days after those services were last provided to the dependent adult, if the donative transfer occurred, or the instrument was executed, less than six months after the marriage, cohabitation, or domestic partnership commenced.”

California Probate Code section 21362 defines the terms “Care custodian” and “health and social services” as follows:

“21362. “Care custodian” and “health and social services” defined

(a) “Care custodian” means a person who provides health or social services to a dependent adult, except that “care custodian” does not include a person who provided services without remuneration if the person had a personal relationship with the dependent adult (1) at least 90 days before providing those services, (2) at least six months before the dependent adult’s death, and (3) before the dependant adult was admitted to hospice care, if the dependent adult was admitted to hospice care. As used in this subdivision, “remuneration” does not include the donative transfer at issue under this chapter or the reimbursement of expenses.

(b) For the purposes of this section, “health and social services” means services provided to a dependent adult because of the person’s dependent condition, including, but not limited to, the administration of medicine, medical testing, wound care, assistance with hygiene, companionship, housekeeping, shopping, cooking, and assistance with finances.”

The recent case Robinson v. Gutierrez (December 26, 2023) 98 Cal. App. 5th 278 involved a situation in which the person who is alleged to have been a care custodian allegedly received free room and board for those services but received no direct payment or other other benefit. The Court was called upon in a case of first impression to determine whether free room and board in exchange for care services are “remuneration” for the purpose of Cal. Probate Code sections 21380 and 21362. The court held that “yes” they are.

The Court’s holding includes a many-page discussion about the legislative intent and also about the use of the word remuneration in other circumstances and in general. Thus, for example, as part of those discussions the Court stated:

“These definitions show that the terms “remuneration,” “pay,” and “compensation” can be interchangeable. As used in section 21362 “remuneration” refers to a form of compensation given in exchange for the provision of care services. The dictionary sources indicate that “remuneration” refers to compensation in the form of money or some other thing of equivalent value. Thus, on its face, the term includes compensation in the form of room and board or other noncash benefits in exchange for the provision of care services.”

Similarly, the Court also stated:

“But because “remuneration” as used in section 21362 can reasonably be read to encompass money, other types of benefits, or both, we turn to the statute’s legislative history and purposes to discern legislative intent. This review further convinces us that the Legislature in this instance intended that remuneration would include room and board given in exchange for care and social services.”

Why is Robinson v. Gutierrez important? The use of fraud and undue influence to obtain a person’s assets upon the person’s death are rampant. And these are challenging cases to bring because a primary witness, the decedent whose assets are at issue, is deceased. Burdens of proof and presumptions are very important in these cases. Further, although the Court in Robinson v. Gutierrez was presented with a free room and board situation, the Court discussed the meaning of the term “remuneration” more broadly in the context of Cal. Probate Code sections 21380 and 21362. Thus, depending on the specific facts and circumstances that are at issue, it might be arguable that any number and manner of other of circumstances other than free room and board might also constitute “remuneration.”

For your additional information, the following is the full copy of Cal. Probate Code section 21380 (and see also the entirety of Cal. Probate Code sections 21380-21392):

“21380. Presumption of fraud or undue influence for certain enumerated transfers; burden of proof; costs and attorney’s fees

(a) A provision of an instrument making a donative transfer to any of the following persons is presumed to be the product of fraud or undue influence:

(1) The person who drafted the instrument.

(2) A person who transcribed the instrument or caused it to be transcribed and who was in a fiduciary relationship with the transferor when the instrument was transcribed.

(3) A care custodian of a transferor who is a dependent adult, but only if the instrument was executed during the period in which the care custodian provided services to the transferor, or within 90 days before or after that period.

(4) A care custodian who commenced a marriage, cohabitation, or domestic partnership with a transferor who is a dependent adult while providing services to that dependent adult, or within 90 days after those services were last provided to the dependent adult, if the donative transfer occurred, or the instrument was executed, less than six months after the marriage, cohabitation, or domestic partnership commenced.

(5) A person who is related by blood or affinity, within the third degree, to any person described in paragraphs (1) to (3), inclusive.

(6) A cohabitant or employee of any person described in paragraphs (1) to (3), inclusive.

(7) A partner, shareholder, or employee of a law firm in which a person described in paragraph (1) or (2) has an ownership interest.

(b) The presumption created by this section is a presumption affecting the burden of proof. The presumption may be rebutted by proving, by clear and convincing evidence, that the donative transfer was not the product of fraud or undue influence.

(c) Notwithstanding subdivision (b), with respect to a donative transfer to the person who drafted the donative instrument, or to a person who is related to, or associated with, the drafter as described in paragraph (5), (6), or (7) of subdivision (a), the presumption created by this section is conclusive.

(d) If a beneficiary is unsuccessful in rebutting the presumption, the beneficiary shall bear all costs of the proceeding, including reasonable attorney’s fees.”

* * * *

Thank you for viewing this discussion. Please do pass this blog and blog post and information to other people who would be interested as it is only through collaboration and sharing that great things and success are more quickly achieved. If you are interested in discussing anything that I have said in the discussion above or in either of my two blogs (see blog addresses below), or if you simply want to reach out or are seeking assistance, it is best to reach me by email at dave@tateattorney.com.

David Tate, Esq. (and inactive CPA)

- Business litigation and disputes – business, breach of contract/commercial, co-owners, shareholders, investors, founders, workplace and employment, environmental, D&O, governance, boards and committees.

- Trust, estate and probate court litigation and disputes – trust, estate, probate, elder and dependent abuse, conservatorship, POA, real property, mental health and care, mental capacity, undue influence, conflicts of interest, and contentious administrations.

- Governance, boards, audit and governance committees, investigations, auditing, ESG, etc.

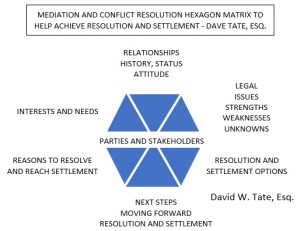

- Mediator and facilitating dispute resolution (evaluative and facilitative):

- Trust, estate, probate, conservatorship, elder and dependent abuse, etc.

- Business, breach of contract/commercial, owner, shareholder, investor, etc.

- D&O, board, audit and governance committee, accountant and CPA related.

- Other: workplace and employment, environmental, trade secret.

Remember, every case and situation is different. It is important to obtain and evaluate all of the evidence that is available, and to apply that evidence to the applicable standards and laws. You do need to consult with an attorney and other professionals about your particular situation. This post is not a solicitation for legal or other services inside of or outside of California, and, of course, this post only is a summary of information that changes from time to time, and does not apply to any particular situation or to your specific situation. So . . . you cannot rely on this post for your situation or as legal or other professional advice or representation, or as or for my opinions and views on the subject matter.

Also note – sometimes I include links to or comments about materials from other organizations or people – if I do so, it is because I believe that the materials are worthwhile reading or viewing; however, that does not mean that I do not or that I might not have a different view about some or even all of the subject matter or materials, or that I necessarily agree with, or agree with everything about or relating to, that organization or person, or those materials or the subject matter.

Please also subscribe to this blog and my other blog (see below), and connect with me on LinkedIn, Facebook and Twitter.

My two blogs are:

http://tateattorney.com – business, D&O, audit committee, governance, compliance, etc. – previously at http://auditcommitteeupdate.com

Trust, estate, conservatorship, elder and elder abuse, etc. litigation and contentious administrations http://californiaestatetrust.com

David Tate, Esq. (and inactive California CPA) – practicing only as an attorney in California.